Open Retail Initiative vs. The Innovation Blockers

In the era of Amazon, retailers understand the value—and necessity—of digital transformation. But the prevalence of single-function, proprietary systems has stymied progress.

“In every major business-computing upheaval, you have a diverse set of ingredients that need to be assembled into a solution,” said George Moakley, VP of IoT Business Development at retail tech provider Volteo. But for retailers saddled with incompatible legacy systems, this has been a seemingly unsolvable problem.

Enter the Open Retail Initiative (ORI), a collaborative effort between top technology companies to bring cloud-native development concepts like containerization and virtual machines to physical retail. This new approach solves the interoperability problem by consolidating workloads at the edge—unlocking new opportunities for automation, service improvement, and revenue growth.

Physical store or the cloud? With Open Retail Initiative, it’s all the same. @volteotech @insightdottech

Transform the Retail Edge into a Cloud Instance

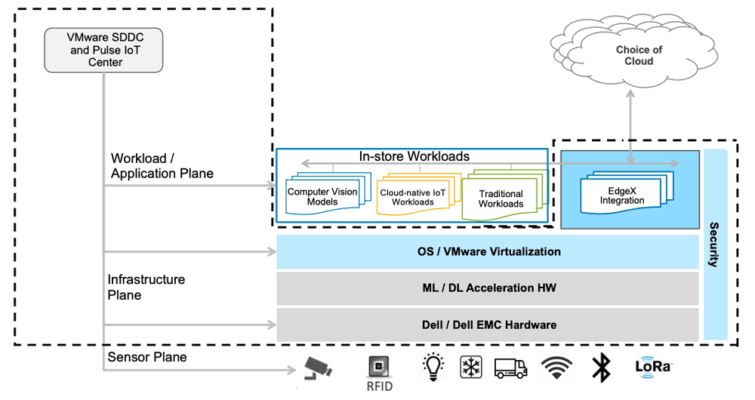

A typical retail edge today consists of a wide array of hardware: point of sale, kiosks, digital signage, video surveillance, RFID inventory tracking, temperature monitoring, etc.—each running on its own system. But with ORI’s interoperability standards, these disparate technology “ingredients” can be consolidated onto one server.

How?

By making the physical edge look more like the cloud. A Linux-based system can host a mix of virtual machines and containers (whether Docker, Snaps, or other), obviating the need to pay for a holistic SaaS service to maintain or connect individual systems (Figure 1). And while servers are expensive, they become much cheaper when multiple applications run on them.

In addition to lowering costs, this consolidation and easy cross-talk among systems opens up countless new business opportunities. Consider the retailer that currently relies on staff to ensure an adequate supply of soap or toilet paper in customer restrooms.

With an RFID system continuously monitoring supplies and automatically communicating with the distribution center instead, “what used to take two hours now takes 10 minutes, and staff can go back to helping customers,” said Chris Timmins, Director of the Open Retail Initiative at Intel.

But inventory management is only part of it. Every aspect of retail stands to be improved, including asset tracking, placement of inventory, and omnichannel strategies. With data freely mixing among systems, it will be easier than ever to deploy new apps that will effectively blur the line between online experience and brick and mortar.

“This area will be so radically different in 5 to 10 years, it’s going to be really interesting to watch,” added Moakley.

Open Retail Initiative Backers and RFID

The Open Retail Initiative has a long list of big-name backers, including Canonical, Dell, HP, SAS, Toshiba, and VMware. This ecosystem supplies important tech, to be sure, but even more important is how the collaboration opens up new possibilities.

For Moakley, the key is keeping the business problem in mind. For example, some of his clients have used RFID technology in the past and were disappointed: “They say, ‘We tried that years ago. It didn’t work.’”

In cases like this, he said, the issue isn’t the technology but how it’s used: “If all you’re doing is adding new IoT seasoning to the same old thing, you’ve put out a lot of money and taken a fair bit of risk for not much benefit.” Just replacing barcode scanners with an RFID scanner, for example, won’t help.

And using single-function, proprietary technology—common in retail today—is a problem all its own. It sets retailers up for what Moakley calls a “technological cul-de-sac,” which is both expensive and risky.

To start, third parties must be engaged to maintain, update, and integrate the technology with other systems. “And heaven forbid your supplier goes out of business,” Moakley added. It’s unlikely you’d find additional capabilities that are compatible with the hardware you already have.

But with the advent of ORI, retailers can avoid tech cul-de-sacs and use new technology in entirely new ways. Think strategically placed RFID trackers, automatically detecting the movement of assets in real time and with accuracy a person could never match.

And the list of benefits goes on—including faster technology deployment, lower maintenance costs, and seamless integration at the edge.

Think Before You Jump

Despite the important advances ORI represents, Moakley stressed the importance of understanding the problems you’re trying to solve before investing in any new technology. In fact, the most successful retailers will have engaged in an open dialogue between the people responsible for business processes that have never been automated before, and IT people who don’t typically think about those processes.

And “don’t get lost in the technology,” he warned. Yes, retailers unwilling to embrace this journey risk their livelihood. But for it to work, he said, “We need to talk about how we’re going to address your business opportunity in a new way, with technology you might have already heard about.”

“It’s a slow process,” said Chris, “not a rip and replace.” Added Moakley, “Not every company should jump today. But every company should have a plan for when they’re going to jump. Because this is how business is going to be conducted going forward.”