First-Class Banking with AI and Facial Recognition

Advances in computer vision can help banks keep their most profitable customers happy. For example, facial recognition can be used to improve security and provide VIP-level service—both critical for banks to compete in wealthy countries.

Among the nations leading the way in deploying this technology is Malaysia. Its booming economy is driving innovation among the country’s banks and technology companies as they seek to increase security and improve service and efficiency.

AI, IoT, and Video Provide an Answer

Developments in these areas are helping banks upgrade security and customer service. For instance, facial recognition software is not just for catching bad guys—it can be used to spot VIP customers as they enter the bank, alerting staff to be ready to provide exceptional service.

Wan Yat Hon, managing director at surveillance specialist Gamma, has been helping banks and other businesses in Malaysia deploy these new technologies.

“Years ago, banks installed low-resolution, VGA analog video CCTV systems,” Wan said. “They can only record and play back. They don’t communicate with alarms or other systems. And their image quality is too poor for facial recognition.” To get a sense of proportion, a 2-megapixel IP camera can produce an image more than six times larger than a VGA analog video image.

The high resolution of megapixel IP cameras enables banks to not only gain an accurate, current view of what’s taking place outside and inside their branches and ATM lobbies, but to gather data that can be analyzed with AI in real time. This facilitates facial recognition and people counting as well as the ability to distinguish body language and gestures that can signify suspicious behavior.

“For instance,” Wan said, “it can identify that an individual repeatedly loiters in front of the bank, and then alert security staff to take notice.”

These applications can also detect when a person tries to enter the bank while wearing a motorcycle helmet, obscuring their face, or that a robbery appears to be in progress at a bank or ATM lobby. In the first example, a guard in a central monitoring station can use a microphone to instruct the person to remove their helmet. In the second example, said Wan, “The guard can tell the bad guy he has 10 seconds to leave before he will be locked inside the ATM area and that the police will arrest him.”

While megapixel IP cameras, AI, and a centralized command center can help secure banks and ATM lobbies, they can also improve customer service and internal operations.

Another part of helping banks become more competitive is to make them more efficient. And AI can help perform that role in various ways. Facial recognition can track personnel within the bank to ensure that only authorized staff enter certain areas or access servers and other equipment. People counting or Crown Detection can inform a manager that more tellers are needed or that a growing line at an ATM signals a potential problem.

Facial recognition systems can also remotely monitor ATM lobbies after hours, enabling banks to increase efficiency in how they deploy security guards. These types of AI applications allow banks to improve security and customer service while lowering costs.

Innovations in IP Camera Systems and Software

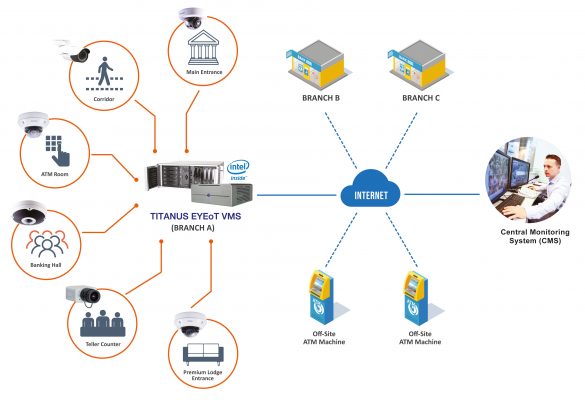

Gamma’s TITANUS EYEoT Lite X2 and X5 solution supports various types of IP cameras providing up to 4K resolution video. Powered by Intel® Core™ processors, the motion-triggered solution produces live video streaming for CCTV monitors to be decoded into data (Figure 1).

Wide-angle lenses and megapixel resolution enable a single IP camera to cover the same area as multiple conventional cameras. This means that a bank can deploy fewer cameras and place them up out of reach of criminals.

The high resolution of these cameras makes it possible to zoom in on details and capture images with very little light, including at night. The resolution, image quality, and accuracy are sufficient to identify people’s faces or license plates—allowing the video to be submitted as evidence in criminal cases.

Banks can also use the system to set up an image database using facial recognition that generates an alert when someone who has acted suspiciously in the past enters the bank. “This person may not be a convicted criminal, but a person of interest a bank wants to observe,” said Wan.

By identifying individuals, banks can also maintain a VIP database of their premium customers. This helps them understand when and how often these customers visit, enabling banks to improve customer service.

Gamma’s surveillance solution also comes with a choice of software. This includes Intel® Active Management Technology (Intel® AMT), which enables Gamma to remotely manage, troubleshoot, and boot up the TITANUS solution. This allows the company to reduce delays so security systems can be up and running, even immediately after a loss of power or when a bank’s most important customer comes to call.

As both technology and the economy improve in Malaysia and around the world, banks and other organizations will find new ways to use AI and facial recognition to improve their business.